Oracle, OpenAI, and SoftBank to Launch $500 Billion AI Infrastructure Initiative

By

Joseph Provence, a news contributor who writes about technology, small business, SEO, and e-commerce.

Jan 21,2025 2:30 PM MST

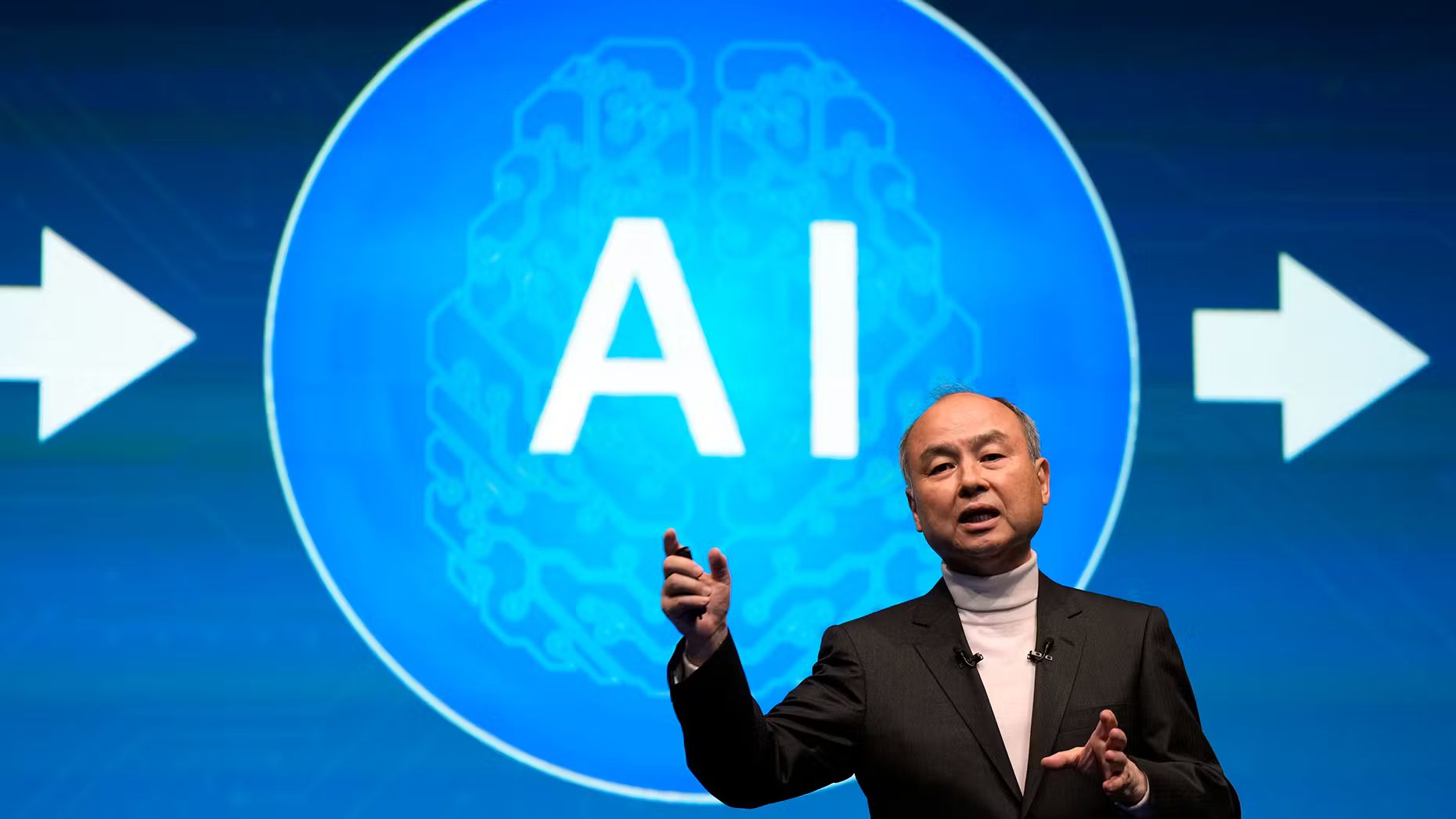

In a landmark development for artificial intelligence infrastructure, Oracle Corporation, OpenAI, and SoftBank are reportedly preparing to announce a massive joint venture dubbed "Stargate," with planned investments of up to $500 billion over four years. The announcement, expected to be made at the White House today, has sent Oracle's stock soaring.

According to reports from CBS News and The Wall Street Journal, the initiative will begin with an initial $100 billion investment, marking one of the largest private investments in AI infrastructure to date. The venture's first project will establish a major data center facility in Texas.

OpenAI CEO Sam Altman, Oracle Chairman Larry Ellison, and SoftBank

CEO Masayoshi Son are scheduled to unveil the details alongside President Donald Trump during a White House ceremony this afternoon.

The news has had an immediate impact on Oracle's market performance, with the company's stock jumping 7% to $172.27. This continues Oracle's strong momentum from 2024, during which the company's shares surged approximately 60% - its strongest performance since 1999.

Barclays analyst Raimo Lenschow views the development as significantly positive for Oracle. "This clearly demonstrates Oracle's strong position as an AI beneficiary and supports the company's multiyear growth story," Lenschow noted in a client report. He added that the announcement suggests the administration's supportive stance toward AI investments, which could benefit the broader software sector.

The joint venture comes at a crucial time for Oracle, whose cloud infrastructure business has been gaining traction among AI startups seeking computing power for algorithm training. However, the company has faced recent challenges, including a disappointing fiscal Q2 earnings report on December 9 that missed both earnings and sales expectations, causing the stock to retreat from its high of $198.31.

Oracle had previously announced plans to double its capital expenditure from the $7 billion spent in fiscal 2024. The relationship between these existing plans and the new joint venture investments remains to be clarified. Oracle has not yet responded to requests for comment on the reported collaboration.

The stock has shown recent signs of recovery, reclaiming its 21-day moving average and posting gains for five consecutive trading sessions. This latest announcement may signal a new chapter in Oracle's evolution as a key player in AI infrastructure development.